Secure generational wealth effectively using offshore trusts asset protection methods.

Wiki Article

Comprehensive Strategies for Offshore Depend On Possession Defense Solutions

When it concerns safeguarding your possessions, offshore counts on can supply substantial benefits. They supply a layer of safety versus financial institutions and lawful insurance claims while also presenting potential tax benefits. Guiding with the intricacies of offshore trusts calls for careful planning and understanding of numerous variables. As you consider your options, it's vital to check out just how the ideal methods can line up with your long-lasting monetary objectives and secure your wide range successfully.

Understanding Offshore Trusts: A Primer

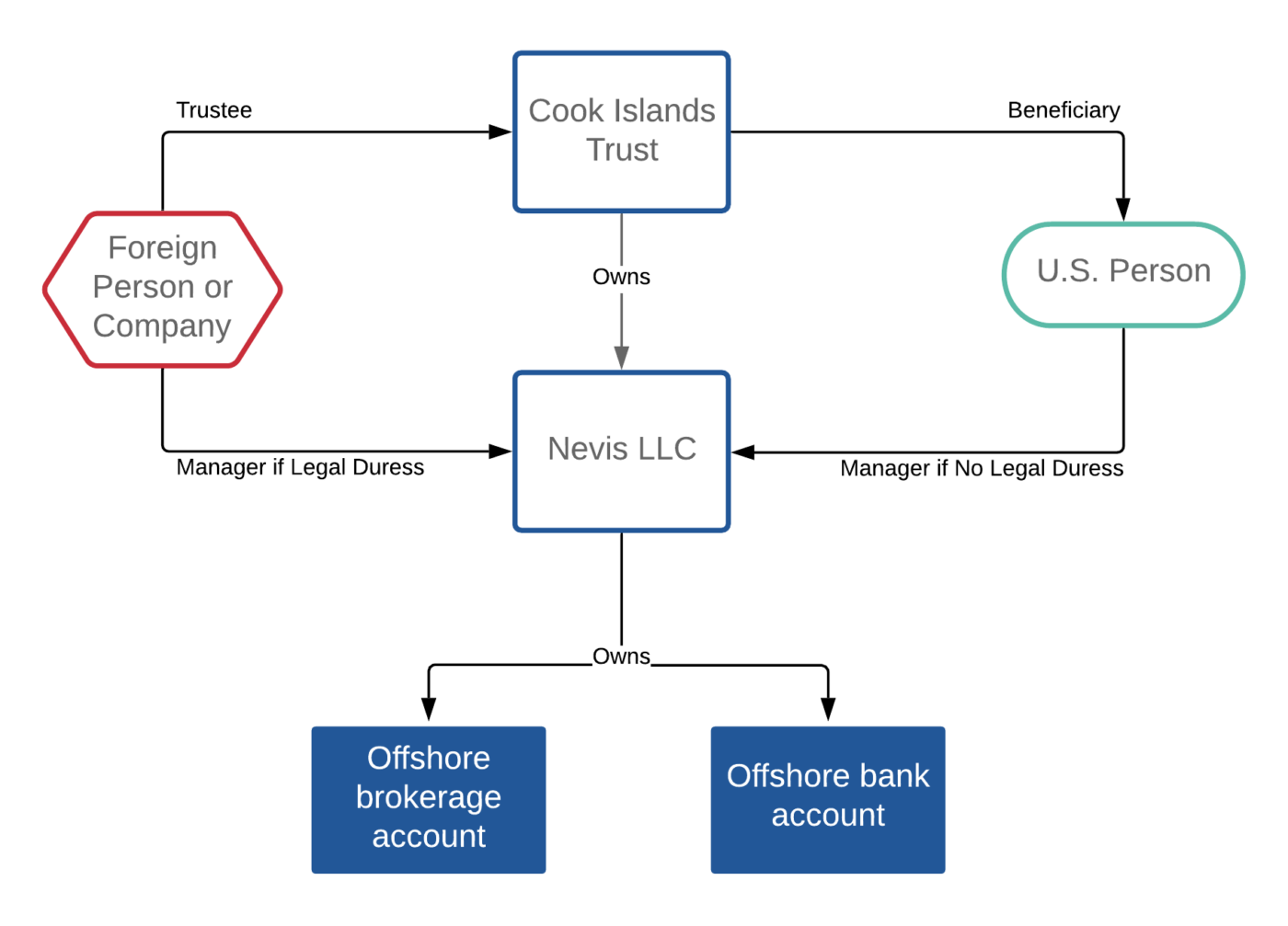

Have you ever before questioned just how overseas depends on can function as an effective device for asset protection? An overseas depend on is fundamentally a legal plan where you transfer your assets to a trust taken care of by a trustee in an international jurisdiction. This splitting up can shield your assets from lenders and suits. By putting your wealth in an overseas count on, you're not simply securing your properties; you're likewise getting personal privacy and possible tax obligation benefits, relying on the jurisdiction.The trustee, who manages the trust, can be a private or a company entity, and they're responsible for handling the assets according to your directions. It's essential to recognize the lawful framework and regulations regulating overseas counts on in your selected area.

Key Advantages of Offshore Trust Fund Asset Security

When you take into consideration overseas count on asset defense, you reveal vital advantages like improved privacy and tax obligation optimization. These advantages not only shield your possessions from potential threats yet additionally aid you handle your tax obligation liabilities better. By comprehending these benefits, you can make educated choices that straighten with your economic goals.Boosted Personal Privacy Defense

Exactly how can offshore rely on property security improve your privacy? By putting your assets in an offshore count on, you get a layer of confidentiality that's hard to accomplish domestically. You can secure your identity given that the trust acts as a different legal entity, making it much more tough for anybody to map properties back to you straight.Tax Optimization Opportunities

While boosted privacy security is a significant advantage of overseas depends on, they additionally supply valuable tax optimization opportunities. By putting your properties in an offshore count on, you can possibly reduce your tax worry with strategic preparation. Additionally, overseas trusts can aid you manage estate taxes, guaranteeing that more of your wide range is maintained for your beneficiaries.Choosing the Right Jurisdiction for Your Trust

Choosing the ideal territory for your count on can greatly affect its efficiency in property protection. You'll intend to think about variables like lawful stability, personal privacy laws, and the level of property defense they use. Some territories supply stronger defenses versus lenders and legal cases, while others might favor tax obligation benefits.Study the track record of each territory and speak with professionals who recognize the subtleties of overseas trust funds - offshore trusts asset protection. Seek locations with well-established legal structures that sustain trust law. In addition, reflect on the simplicity of establishing and maintaining the trust fund, including any administrative obstacles

Kinds of Offshore Trusts and Their Uses

Offshore trust funds are available in numerous types, each customized to fulfill details requirements and goals. One usual type is the discretionary count on, where you can provide trustees the power to make a decision just how and when to distribute properties. This versatility is optimal if you wish to protect properties while enabling for future modifications in beneficiary needs.Another alternative is the spendthrift depend on, created to stop beneficiaries from wasting their inheritance. It safeguards assets from financial institutions and assurances they're made use of carefully. If you're concentrated on estate preparation, a revocable trust enables you to handle your properties while you live, with the capability to make adjustments as needed.

Finally, charitable counts on can supply tax advantages while supporting your kind objectives. By choosing the best sort of overseas trust fund, you can effectively secure your assets and attain your economic purposes while delighting in the benefits these structures provide.

Legal Conformity and Regulatory Considerations

When considering offshore depends on, you require to understand the lawful structures in different territories. Conformity with regional regulations and reporting obligations is essential to ensure your property protection strategies work. Disregarding these regulations can bring about significant penalties and undermine your count on's objective.Administrative Lawful Frameworks

Each jurisdiction has its own regulations regulating trust funds, which can substantially impact your possession protection initiatives. You need to understand exactly how local policies influence the establishment and management of overseas depends on. This knowledge helps you browse prospective challenges and guarantees that your depend on operates within the law.Reporting Commitments Conformity

Understanding your coverage commitments is essential for keeping compliance with legal and regulative frameworks connected with overseas depends on. You'll need to remain notified concerning the details demands in the territories where your trust runs. This includes filing needed records, revealing recipients, and reporting earnings produced by trust fund properties.

Consistently consult with legal and tax obligation professionals to assure you're satisfying all obligations. Adhering to your coverage obligations not only protects your possessions yet likewise enhances your depend on's reliability.

Techniques for Taking Full Advantage Of Personal Privacy and Protection

To see this website improve your personal privacy and safety and security while making use of offshore depends on, it's necessary to implement a diverse technique that includes mindful territory choice and durable legal frameworks (offshore trusts asset protection). Begin by selecting a jurisdiction recognized for its solid privacy legislations and property defense laws. Research study countries that do not disclose count on details this page openly, as this can shield your properties from prying eyesFollowing, think about utilizing a nominee trustee to further distance your identification from the trust fund. This can add one more layer of privacy, as the trustee takes care of the possessions without revealing your personal details.

Additionally, maintain your depend on files safe and secure and limitation accessibility to them. Use encrypted communication methods when discussing trust-related matters, and prevent sharing sensitive details needlessly.

Regularly review your approaches and remain educated regarding any kind of changes in legislations that may influence your personal privacy and safety. Taking these aggressive actions can considerably boost the privacy of your offshore trust properties.

Engaging Expert Advisors for Effective Preparation

While traversing the complexities of overseas counts on, engaging specialist consultants can greatly improve your preparation efforts. These specialists, consisting of lawyers, accountants, and economic coordinators, bring specialized knowledge to the table, ensuring you navigate the lawful and tax ramifications effectively. They can assist you identify the finest territory for your trust, taking into consideration aspects like possession defense legislations and tax obligation advantages.By working together with these experts, you can customize your depend satisfy your certain needs and goals. They'll additionally help in maintaining conformity with progressing guidelines, which is crucial for safeguarding your assets. Furthermore, advisors can offer ongoing assistance, aiding you change your strategy as your conditions alter.

Buying expert guidance might seem pricey in advance, but the lasting benefits, consisting of boosted safety and security and comfort, far surpass the initial expenditures. So, do not think twice to look for skilled consultants that can direct you with this complex process.

Frequently Asked Concerns

How Can I Ensure My Offshore Trust Continues To Be Compliant Over Time?

To guarantee your overseas trust fund continues to be certified over time, frequently evaluation guidelines, involve a qualified expert, and maintain accurate documents. Remaining informed concerning adjustments and adapting your trust accordingly will aid preserve its compliance and efficiency.What Expenses Are Linked With Establishing up an Offshore Count On?

Establishing an overseas trust includes various costs, including legal costs, management costs, and prospective tax implications. You must also think about continuous maintenance charges, conformity costs, and see post any kind of costs from financial establishments involved in managing the depend on.

Can I Modification Beneficiaries After Establishing an Offshore Depend On?

Yes, you can change beneficiaries after developing an offshore trust. You'll need to comply with the count on's terms and consult your lawyer to assure whatever's done legally and according to your certain desires.How Do Tax Obligation Effects Vary by Territory for Offshore Trusts?

Tax ramifications for overseas trust funds differ substantially by jurisdiction - offshore trusts asset protection. You'll require to research each place's laws, as aspects like income tax obligation prices, inheritance tax, and reporting demands can considerably influence your trust fund's financial outcomesWhat Takes place if I Die Without Upgrading My Offshore Trust Fund?

If you pass away without updating your overseas trust, your assets may not be dispersed as you meant. This could bring about disputes amongst recipients and prospective tax issues, inevitably threatening your original estate planning objectives.Final thought

In recap, maneuvering via overseas count on possession security can be complicated, however with the best techniques, you can efficiently shield your properties from potential dangers. By selecting a trustworthy territory, understanding legal structures, and functioning with experienced experts, you'll enhance both safety and tax obligation benefits. Consistently assessing your trust fund's compliance ensures it continues to be robust and straightened with your economic objectives. Take aggressive actions currently to guard your future and enhance your comfort.Report this wiki page